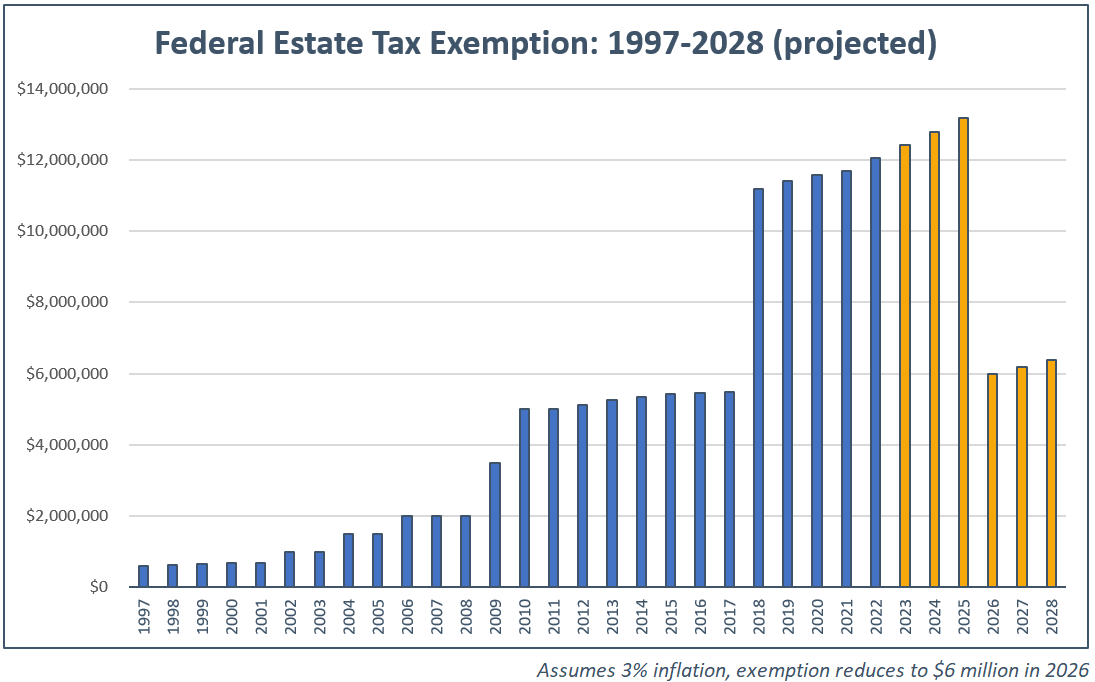

2025 Federal Estate Tax Exemption - Historical Estate Tax Exemption Amounts And Tax Rates, Lifetime estate and gift tax exemption. Estate Tax Exemption Sunsetting After 2025 How It Affects Your, It consists of an accounting of everything you own or have certain interests in at the date of.

Historical Estate Tax Exemption Amounts And Tax Rates, Lifetime estate and gift tax exemption.

Here are the new numbers and considerations for 2025: Married couples can expect their exemption to be $27.98 million (up from $27.22 million last year).

2025 Federal Estate Tax Exemption. Client, who dies in 2025 can gift at death from their. With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and estate tax.

Estate Tax Exemption Increases for 2025, If an individual gives more than the annual exclusion amount, the excess counts toward their lifetime estate and gift tax exemption, which.

Federal Estate Tax Exemption 2025 Making the Most of History’s Largest, Starting january 1, 2025, the federal lifetime gift, estate, and gst tax exemption amount will increase to $13,990,000 per person or $27,980,000 for a married couple.

Nba All Star Lineup 2025. Freshman (18) stats (as of 12/10/24):. 1 pick in the 2026 nba draft, announced his...

Are You Prepared for the 2025 Federal Estate Tax Exclusion Limit Sunset, In other words, giving more.

Wsf Grand Nationals 2025. Teams must win a bid at a cheerleading worlds bid. Stream or cast from your desktop,...

Oregon Archery Elk Season 2025. It targets information for big game hunters, such as deer, elk, and bighorn sheep. Archery...

Federal Estate Tax Exemption to “Sunset” Savant Wealth Management, The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Estate Tax Exemption 2025 Paige Barbabra, The irs has announced that in 2025, the lifetime estate and gift tax exemption (the lifetime exemption) will rise to $13,990,000 (from $13,610,000);